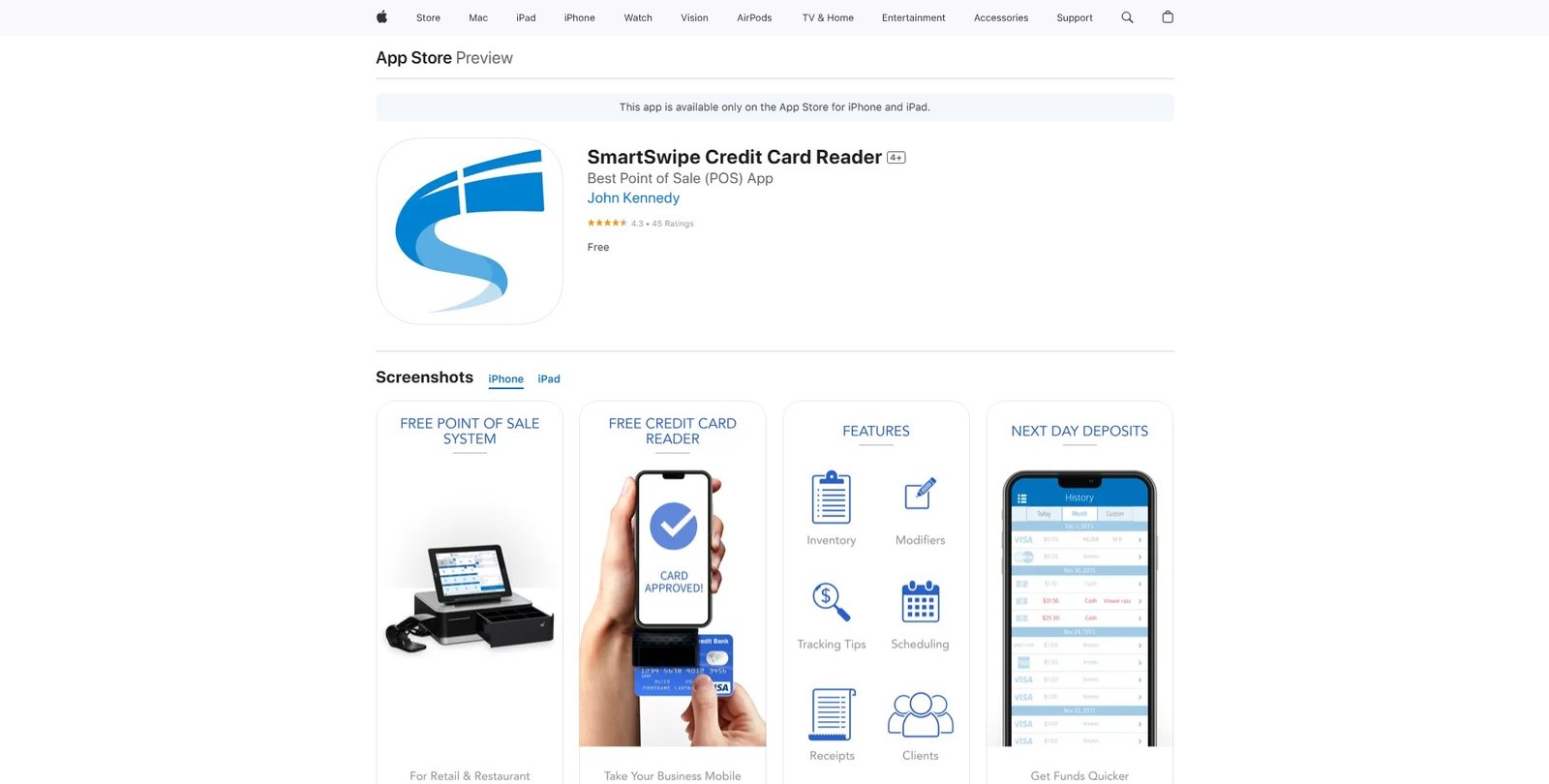

Developing the SmartSwipe Credit Card Reader iOS app involves designing a robust, secure, and intuitive app for seamless credit card processing. Here’s a detailed roadmap for creating the app:

App Features:

Card Reader Integration: Support for hardware credit card readers (e.g., Square Reader or custom device). NFC support for contactless payments. Manual entry for card details as a backup.

Payment Processing: Capture and process payments securely. Real-time authorization for transactions. Split payments across multiple methods (credit/debit/cash).

User Management: Customer profiles for transaction history and receipts. Merchant accounts for managing funds and reports.

Transaction Management: Detailed transaction logs with filters (date, amount, customer). Issue refunds, void transactions, or generate receipts. Offline payment mode with auto-sync when online.

Reports & Analytics: Sales summaries (daily, weekly, monthly). Insights into customer spending trends and popular products.

Security: PCI DSS compliance for secure payment processing. Tokenization for sensitive data like card numbers. Biometric authentication for merchants (Face ID/Touch ID).

Notifications: Real-time transaction alerts. Payment failure/reversal alerts.

Additional Features: Multi-language support for global merchants. Tax calculations and tips. Support for multiple currencies.

Technology Stack:

Programming Language: Swift (for native iOS development).

UI Framework: SwiftUI or UIKit.

Payment SDK: Stripe Terminal SDK, PayPal Here SDK, or custom integration.

Database: CoreData or Firebase Realtime Database for local storage; cloud databases for syncing.

Hardware Integration: SDKs from manufacturers like Square, BBPOS, or custom APIs. NFC integration via Core NFC (for contactless cards).

Encryption: SSL/TLS for data transmission. AES encryption for local data storage.

Key Modules:

Authentication: Secure login for merchants (OAuth, biometric). Role-based access for multiple employees.

Card Reader Integration: Detect connected card reader via Bluetooth, audio jack, or USB. Handle swipes, dips (EMV), and taps (NFC).

Payment Workflow: Interface for inputting amounts and capturing payments. Real-time feedback on payment status (success, failure).

Transaction History: Display detailed logs with customer and transaction details. Export reports in CSV or PDF format.

Settings: Configure tax rates, tipping options, and currency preferences. Manage hardware pairing and firmware updates.

Development Workflow:

Design: Prototype with Figma or Sketch. Optimize UI for merchant ease-of-use and quick transactions.

Development: Set up hardware integration (e.g., card readers). Implement payment workflows and APIs for transaction handling.

Testing: Test with real hardware devices for swipes, dips, and taps. Simulate edge cases like network interruptions or failed payments.

Deployment: Ensure App Store compliance for apps handling financial data. Provide detailed setup instructions for merchants.

Compliance Note:

PCI DSS: Adhere to standards for secure data handling.

Strong Encryption: Encrypt all sensitive data (e.g., card numbers).

Audits: Perform regular security audits to ensure compliance.